UBL invoices, a UBL invoice is not difficult to make

UBL Invoices, the basis for carefree invoicing

Many texts on the internet start with a technical explanation spelled out UBL as an abbreviation, our impression is that the average reader is not waiting for that explanation, they just want to understand exactly how things work with UBL invoices and to assess any added value and to arrive at a cost benefit/analysis. This article attempts to give a practical interpretation to this and provides an explanation at the bottom of this article about the UBL (pre)history, the standard, current technical implementation, pitfalls and EasyData’s UBL vision for the future.

First of all, we start with the benefits of UBL Invoicing!

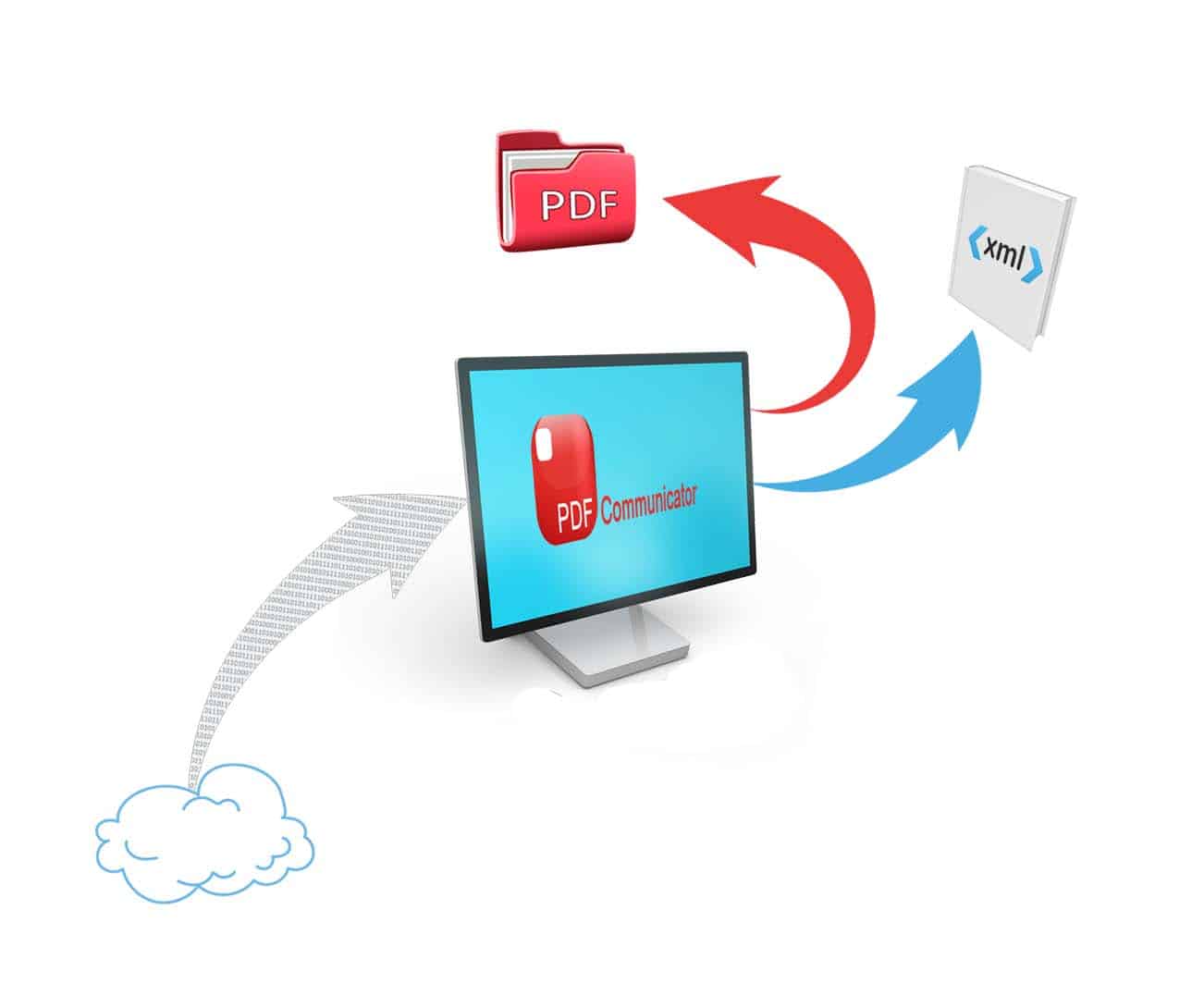

UBL Digital invoicing, a PDF with XML

A UBL invoice is a machine-readable summary of the invoice as people understand it. We like it when an invoice has the supplier’s logo, pleasant colors and a clear lettering that reassures us that we are doing business with the right supplier. A computer does not care much for those aspects, it just wants the data in the right place in our accounting software with as little hassle as possible on behalf of our software engineers and effective users. For this purpose we use an XML, a separate file that contains invoice information in an agreed manner. In this case, according to the UBL standard, these agreements are easily accessible by EasyData for every organization.

UBL Invoices, the basic values to book an invoice

The generated UBL seems a bit magical when you look at the content and we therefore advise not to do that, we assume for the sake of convenience that the data on the PDF invoice corresponds to the XML. If that is not the case, there is something really wrong that will certainly become visible as soon as you have read the invoice into your accounting software. It is possible that the UBL file only contains summary invoice data such as invoice date, total amount, IBAN number, etc. The agreements made to create a UBL file contain a minimum set of agreements. Without that data there is no question of a valid UBL file and even more annoying, without that basic set of data you simply cannot book your invoice! Do you want more than the set of UBL basic data? then read on!

UBL Invoices, the end for invoice recognition?

Yes, eventually. As soon as the acceptance of UBL XML (or any other exchange platform) has been accepted by all parties involved and used in the trading process, we are done with that piece of automation. EasyData feels compelled to explain the advantages of this UBL format in detail to our customers. The benefits for further optimization of administrative processes have increased enormously with UBL acceptance. Our service does not stop after traditional invoice recognition by UBL has become superfluous, it only makes our field of work more interesting!

Notice Line-Item conversion to UBL invoice

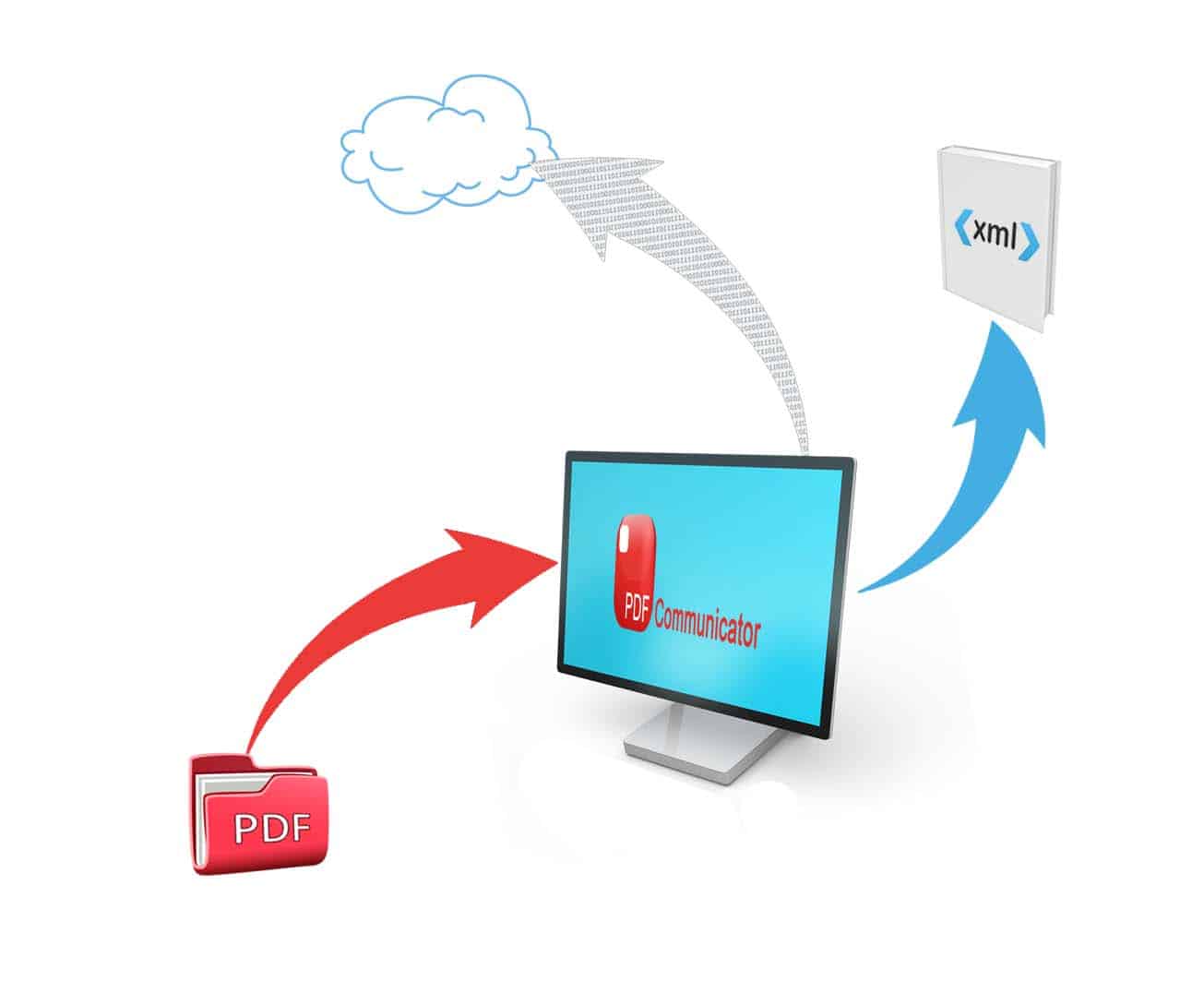

PDFCommunicator realizes standard line recognition: The most complex invoices are made structured in an UBL XML using PDFCommunicator. Online providers of invoice line recognition charge mostly more for converting Line items into UBL. There is nothing wrong with that, but we choose not to do so. Just get your line items to UBL by smart UBL invoice without paying extra. And the other good part is that PDFCommunicator works on your own computer, no Cloud application.

The UBL invoice solution that produces PDFs!

As most invoices travel as PDF nowadays, it’s just a visual expression of an E-Invoice. For efficient processing this PDF needs to be combined with an invoice data XML. PDFCommunicator delivers exactly that, a PDF with line item XML content. We use UBL (Universal Business Language) as our XML output standard. Although PDFCommunicator delivers any XML, the solution to get office automation is here!

The UBL (Universal Business Language) history

Digital invoicing is not a thing of the past. This development goes back to the EDI standard that came into use from 1960. EDI stands for “Electronic Data Interchange” and is still used in a variety of applications. In the Netherlands, use mainly takes place in the food industry and associated logistics companies. Many years later, various abbreviations and dialects of the EDI standard have emerged.

EDI standard

The EDI standard stands as a concept in common use today. For example, Google the abbreviation ‘EDI’ and a world of digital communication protocols will open up to you! In line with the development of the EDI standard, Jon Bosak of OASIS developed the first UB version as we know it today back in 2001.

This first UBL XML was released for industrial use in 2004 and bears a number of similarities to the earlier EDI -standard. An important difference that explains the success is that the UBL standard can be used without licensing costs. That is the big difference with the EDI standard, which does have operating costs.

At that time, external business processes were already so intensive that initiatives to reduce the administrative workload translated into the first electronic standard for sharing financial information. A uniform standard in which suppliers and customers communicate, the

EDI standard was born! The unified EDI protocol enabled exchange between different computer systems for the first time in the history of office automation.

From the EDI standard to UBL invoices

The IDE standard is still widely used, although with current developments we see that the importance of EDI is declining. This is how we make the step to UBL, which promises to make invoice processing faster and error-free. The power is in the repetition, so once again: The UBL file is an XML document made according to the agreements made in the UBL XML format, the UBL standard. This means that this XML file contains the same information as the visible PDF invoice that is usually sent together with the XML UBL. UBL and PDF is the modern digital invoice combination that is sent as a combination to the receiving merchant. In summary, with UBL interpretation you don’t need any manual interaction. invoice processing is completely automatic, no more retyping invoices!

UBL acceptance and status quo

The UBL standard is currently adopted by many accounting packages. The circle of invoicing automation looks like a closed one from a technical point of view.

EasyData automates any invoice reading process, even outside the scope of UBL, for example for systems that cannot create their own UBL. At the same time, EasyData is not the only company on the market in this area. The number of developments with different approaches is growing, and some of them use our technologies as well.

We are always open to partnership.

UBL lifts barriers

We believe that with UBL the standard for business communication is created: Information exchange without a third party. The freely usable UBL format provides freedom in financial communication between involved partners.

Putting pieces together with EasyData

Naturally PDFCommunicator does not solve everybody’s needs directly. That’s where you find EasyData as a flexible partner at your side.

You can get Cloud applications with our digital transformation platform for evaluation purposes and on premises solution is available too. It’s all about your needs based on your requirements. And it hasn’t to always be invoice UBL reading or UBL invoice printing.

UBLization

The exchange of UBL format is much wider than just invoices, there is no need to box into just invoicing information. Or, generally speaking the UBL Schema is as flexible as we are, any we can implement any XML schema. Think of automatic XML generation of orders for instance, or standardization of quote information. The possibilities are endless and will lead to a reduction of administrative burdens!

Because of the overview, we limit ourselves to the popular UBL invoicing solution. Although we do have the technology to convert any type of document to XML and able to convert any XML to the UBL standard. Try UBL invoicing today!

Integration via…

Organization-specific integration is possible through various portals and accounting systems available today.

So the government’s invoicing requirements can be met simply by submitting a UBL. In this case, the e-invoice format will be converted by the platform used. This is a new phenomenon in modern electronic invoicing, where whoever sends e-invoices autonomously ends up with different providers.

One such initiative is the PEPPOL network, with large companies at the forefront. They see the advantage of such a platform in reducing administrative costs, for example, electronic invoicing saves money and does not allow for errors in the interpretation of invoices. As such, more and more organizations are seeing the benefits of electronic invoicing through PEPPOL. And you, too, can take advantage of the extensive capabilities of PEPPOL.

Belgian UBL specifics

On July 7, 2012, Belgium first created its own ‘proprietary’ e-fff UBL 2.0 format, based on UBL 2.0. It significantly restricts fields (up to 200 virtual fields) and acts like a ‘general’ UBL. But it was quickly overtaken by the portal http://peppol.eu/. The standard is also slightly different, and more importantly, you need a third party to send your invoice. Interestingly, the Belgians see it as a new standard, and the CENBII working group is preparing a European standard.

German way to UBL

Our other neighbor, viewed from the Dutch point of view, is Germany, and they have a completely different system, which they say will become the standard. Germans wrap XML to PDF, so the document contains PDF A/3 and XML XRechnung. Again, the German way to automate invoices is a document that contains both PDF and XML in one file. EasyData has been using this XFA technology for over 10 years, in particular for archive applications, but more recently for invoice automation.

What’s ZUGFeRD?

Let’s take a closer look. The new ZUGFeRD 2.0 is compliant with the European standard EN 16931 and includes the “Leitweg-ID” field, a government department identifier field required for electronic invoicing of government administrations. You can find further information on the website http://www.ferd-net.de or from the EasyData specialists.

The main idea of ZUGFeRD is that everyone can exchange electronic invoices without prior consultation or approval. The ZUGFeRD data format for e-invoices is available free of charge.

Unity in variations

To sum up, each country believes that their solution will become the European standard. The above interpretations do not serve to criticize standardization, but is rather a summary to indicate different technical and political sentiments. Initially, an open standard will be perceived differently by different governments. The advantage is that most accounting systems nowadays can use UBL XML. In case you have other XML formats for incoming invoices, EasyData can handle any format other than XML in our automated invoicing process.

UK stands on its own

The Brexit is an established fact. What about electronic invoicing in the United Kingdom? In 2015, the UK passed the Small Business, Enterprise and Employment Act, which regulates electronic invoicing. At the same time, Wales, Scotland and Northern Ireland have their own rules, and the above-mentioned law does not apply to them. The UK is trying to be careful about the costs associated with invoicing technology.

EasyData can help you solve your UK account problems.